Strategic Plan Consultants

Personal Touch in an Automated World... Your Independent Plan Resource

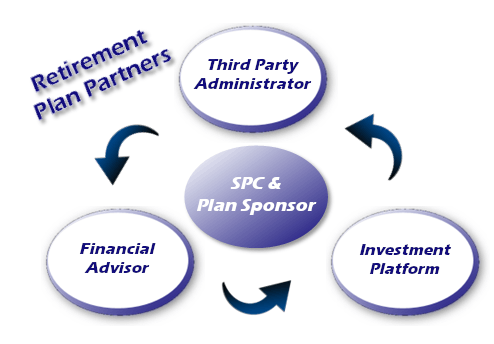

What do we do? SPC helps Business Owners build the best retirement plan for their individual needs and employees. See the SPC difference for yourself...

With our team's combined experience of more than 30 years in the retirement plan administration industry, we have seen how business owners & their employees have been left behind in a sea of information & automation without true guidance. SPC can change that for you.

We built Strategic Plan Consultants to fill the need in the retirement plan industry for an independent partner to provide truly independent advice & consulting for businesses & business owners. Contact us today to see the difference SPC can make for your business. It's a Great Day to 401k!!

Plan Sponsors click below to get started today... How can SPC Help You?

Follow the links below or call us at (817) 983-7444 to get started.